It’s hard to tell whether demonetisation will turn out to be a bold hit or a costly miss, but it appears to many that the government has taken the black money bull by the horns. Announcing the withdrawal of ₹500 and ₹1,000 notes, Prime Minister Narendra Modi listed several steps that his government had taken so far in its war on black money:

Looks impressive, what’s not to like? Just that, once you discount the hype, it’s not very different from what’s been done by past governments, whether the United Progressive Alliance (UPA) or the United Front (UF).

Show me the money

Consider the figure of ₹1,25,000 crore collected over two-and-a-half years. The government hasn’t provided a break-up, but based on Finance Ministry replies to parliamentary questions, it includes the following:

₹65,250₹67,382 crore declared under the 2016 Income Disclosure Scheme (of which 45% will flow in as actual taxes)- ₹21,354 crore of undisclosed income seized from individuals and businesses (under Section 132(4) of the Income Tax Act)

- ₹22,475 of additional income assessed from taxpayers by surveys (carried out under Section 133A of the Income Tax Act)

- ₹8,186 crore of undisclosed income held by Indians in accounts with HSBC Geneva, revealed by the French government in 2011

- Around ₹5,000 crore of offshore holdings by Indians that an International Consortium of Investigative Journalists investigation exposed in April 2013

All of which adds up to ₹1,22,265 ₹1,24,397 crore, close enough to our headline figure. But how remarkable is this effort?

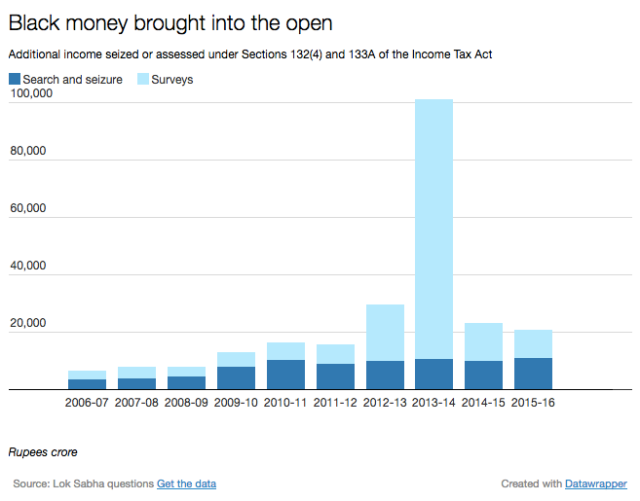

The income disclosure scheme is a one-off (more about that later), but what about the black money brought into the open via searches, seizures and surveys? The chart below shows the record in previous years (source here):

Isn’t that interesting. Using the same definitions used by the Modi government, it turns out that the quantum of black money exposed in the last two years of the UPA was more than ₹1,30,800 crore. That’s right – the UPA tracked down more black money than the Modi government did, and in a shorter time frame.

Isn’t that interesting. Using the same definitions used by the Modi government, it turns out that the quantum of black money exposed in the last two years of the UPA was more than ₹1,30,800 crore. That’s right – the UPA tracked down more black money than the Modi government did, and in a shorter time frame.

As always, there are caveats. Not all the money assessed under Section 133A should be strictly considered “black”; some of it consisted of income that taxpayers felt was not taxable for whatever reason, but the authorities disagreed. Still, if the Modi government wants to count all those funds under its “black money” haul, it cannot deny the UPA credit for a bigger haul.

Bring back the money

That’s fine, you might say, but hasn’t the Modi government adoped a much more comprehensive approach to black money than the scam-tainted UPA? It’s passed bills to bring back black money, succeeded with its income disclosure scheme and, as Modi himself stated, reached agreements with many foreign countries to provide tax information.

Let’s take these one-by-one.

The Modi government has indeed passed bills that raise the penalties for the concealment of foreign income and beef up the handling of benami properties, and we have to see what effect they have. But it’s not clear that income disclosure schemes even work, leaving aside the obvious unfairness of giving tax criminals a break while the rest of us cough up our cash. A similar scheme in 1997 resulted in close to half a million persons declaring ₹33,695 crores of previously undisclosed income, equal to ₹85,153 crore in current rupees and a third quarter higher than the Modi government’s bounty. I think we can all agree that it didn’t make much of a dent in India’s black money problem.

What about black money transferred outside of India, which the Washington DC-based Global Financial Integrity estimates averaged US$51 billion per year between 2004 and 2013 (some of which likely returned as foreign investment via “round tripping”)? In his demonetisation announcement, Modi referred to “agreements with many countries, including the USA… to add provisions for sharing banking information” that could help make international tax evasion more difficult.

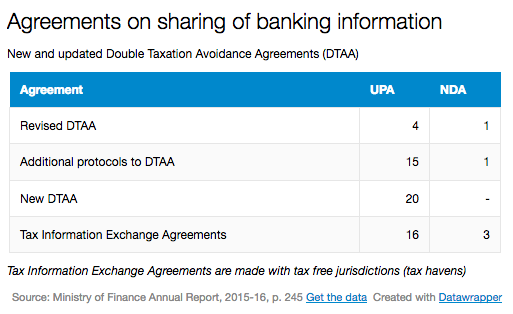

A process has been underway since the 2009 G20 summits in London and Pittsburgh to improve transparency in international financial transactions. This has translated into an effort to include banking information in both existing and proposed Double Taxation Avoidance Agreements (DTAA) that India has (currently with 95 countries), and to reach Tax Information Exchange Agreements with countries that India doesn’t have a DTAA with, mostly tax havens such as the Bahamas, British Virgin Islands etc.

The table below shows that the UPA accounts for much of the progress so far, although this could change over time; the Modi government is currently negotiating another 53 DTAAs.

That doesn’t mean that the Modi government has been lagging: in May 2016 it finalised an important DTAA renegotiation with Mauritius, the island nation that has been the source of a third of all FDI inflows since April 2000, and is believed to be the main gateway for round-tripping. India will impose a capital gains tax of half the Indian rate on investments from Mauritius starting from April 2017, and the full rate from April 2019. A similar agreement with Singapore, the second largest source of FDI into India (16% of the total), is in the pipeline. The idea is to remove one incentive for round-tripping: saving on capital gains tax.

There is also a broader multilateral effort under the OECD umbrella to facilitate the automatic sharing of taxation-related information. It began with the Convention on Mutual Administrative Assistance in Tax Matters, that India joined in 2012 and now covers 106 countries and jurisdictions. India (under the UPA) became one of 47 countries to sign the Declaration on Automatic Exchange of Information in Tax Matters in May 2014, which led to the establishment of the OECD-led Global Forum on Transparency and Exchange of Information for Tax Purposes that is now at the core of international data sharing. In June 2015, the Modi government took another step forward by signing the Multilateral Competent Authority Agreement on Automatic Exchange of Information, under which 54 countries including India will start automatically sharing financial data from September 2017.

In summary, there has been a robust G20-supported process underway for several years to bring transparency to international financial information, which Modi certainly didn’t start, and had little choice but to go along with.

The bottomline: Modi’s demonetisation drive marks an ambitious break from past practice. But his claim that previous BJP policies have brought in an unprecedented amount of money is just a jumla.

This article which contains facts and figures collected from various govt agencies and from parliament question hours, has exposed the falls claims of modi and his govt. The author needs to be congratulated for this excellent article, which is an ey opener for all to differentiate between the facts and the claims.

thoughful article with figures

first time i have read an article written by statistician not a poet

What kind of stat guy does not disclose the source of the data claimed?

I cannot find the ‘lok sabha’ data source?

The article is hogwash and is intended to misguide the readers, just like the liberals did after JNU incident, all of them called the video as doctored, but nobody dared to go the court against the channel, because, the liberals are liars, they lie well, but they cannot lie all the time.

If you’d spent your time reading rather than outraging, you would have noticed a very clickable link just above the chart which says “(source here)”.

Unfortunately stupid people cannot see links. Tell me did you see the link to the source or are you stupid?

it seems 10k crore declaration in hyderabad was a fake one, for the recently ended IDS. This is the current headline in the ‘deccan chronicle’ of 20-11-2016.

it seems that the trader was hardly worth 1 crore, so the suspicion is that he was acting as a front for someone else.

so the estimate goes for a toss, if this is true.

not sure how you link the data, but have you given thought to the possibility that the data you use to write your report may be ‘changed’ after you publish your column?

it would go very far in proving you as a fake, much to the delight of certain segments of the population.

sometime very soon, the burnol offers are going to turn into burn-all offers. Much is at stake in the republic.

advice adequate caution.

All the claims covered here are publicly recorded in the media and in Parliament, difficult to cook the books retrospectively even if they wanted to.

well, you never know until you give it the old college try. it is not like they have not made any efforts to ‘fix’ the data, when the actual numbers were not very great.

you seem to have some confidence in the media. i have given up on them a long time ago. they have their licenses to worry about, and by god, the ad revenue.

the powers would like them to just report on what the powers say, and a big NO to any investigative efforts. glorified stenographers, all of them.

not sure why they even go to the press conferences, just install one camera, and all the channels could share that feed. would save them a lot of money, and a few people might get to pursue their favorite hobbies.

they are still not blatantly lying just yet, but i guess it might start from the next year. i mean the media, the powers, no comments.

After all, we have always been at war with eastasia, or was it oceania? i forget.

i am always in awe of optimists like you, i read you and a few others just to keep myself from going deep into the well of despondency. 🙂

Pingback: Jumla is the New Black: Has Modi Really Rescued India From Black Money? – Sword of DeMonetization / DeModitization in India

Very good information. Congrats to all behind this

Good data – amid all the Hubris and FUD.

so, another one pops out and says his 13,000 crore declaration in IDS is a fake one. That makes it 23,000 crore off the total of 65,000 odd crores.

would that process be considered a success?

time for collective punishment.

This is getting really interesting.

Legal violations are aplenty in this environment.

The RBI says people can withdraw Rs 10,000 per day and Rs 24,000 per week, per person. Banks are locally adjusting and making their own decisions, in complete violations of the RBI dictates. I wonder if someone is going to take the banks to court for this violation.

The IT IDS scheme was supposed to be confidential on all accounts as per the government claims. Not only do they have to protect the data of the filers, they should not be saying what fake filings have taken place either. That is another violation.

By the way, the IT department now claims that the Rs 13,000 crore filing was not part of their Rs 65,000 crore figure declaration. They also say they have also excluded and Rs 2 Lakh crore declaration as well, which was not public knowledge in the first place.

I wonder why they are not respecting their own confidential clauses. Would they give this information out if an RTI was filed?

The PM and other powers go on making rules everyday, not sure if any of them are legal, or on the edge or completely not legal.

Not many are giving change for the Rs 2000 note, even when there are sureties by the government. Whether that is legal or not, people should decide.

This would be ironic, were it not for the daily tragic consequences.

Please recheck the main graph – the numbers don’t add up. Undisclosed income brought out through seizures and surveys in last two years of UPA-2 rule, as per your data link, add up to INR 130,810 Crore. Same as your write-up. But while the graph shows correct figure for 2013-14, the figures for 2012-13 and 2011-12 seem incorrect. For 2012-14 cumulative figure to be more than INR 130,000 Crore, 2012-13 figure in graph has to be more than INR 20K. It is not.

Quite right, well spotted. The correct figure for 2012-13 is ₹29,630 crore. Have made the correction, thanks.

I didn’t mention but do check previous years numbers as well.

Have done so, it’s all in order thanks.

Reblogged this on theangrysaint.

Oh, this is very very interesting.

This is about the demonetisation, so if this is off-topic, please do not publish.

The RBI is unwilling/unable to tell how many notes have come back. One story I read is that using the high capacity sorting machines they have, it is going to take 600 days to count them all.

Estimates by third parties came to the conclusion that Rs 15 lakh crores of old notes have entered the RBI vaults.

I think this does not include the following..

1. holding by the various co-operative banks across india

2. holdings by countries such as nepal, bhutan, bangladesh etc

3. holdings by NRIs

4. holdings by PIO/OCI and other country citizens. this is possibly classified illegal per RBI

5. holdings by those hat facilitate exchange in other countries like dubai, sri lanka, singapore.

6. payments in the various IDS schemes that are valid till sometime in next year, not sure if old notes are allowed here.

The current goal of RBI seems to be to deny, as much as possible, any new returns.

Reports of Category 3 people being prevented from entering 4/5 designated RBIs are all over in the media.

It is going to be interesting to see if Mr Urjit Patel is going to turn up in front of the PAC committee on January 20,2017, and if he does, then what he says.

Maybe you could do an article on this one, unless you already are?